Form 4562 Instructions 2024

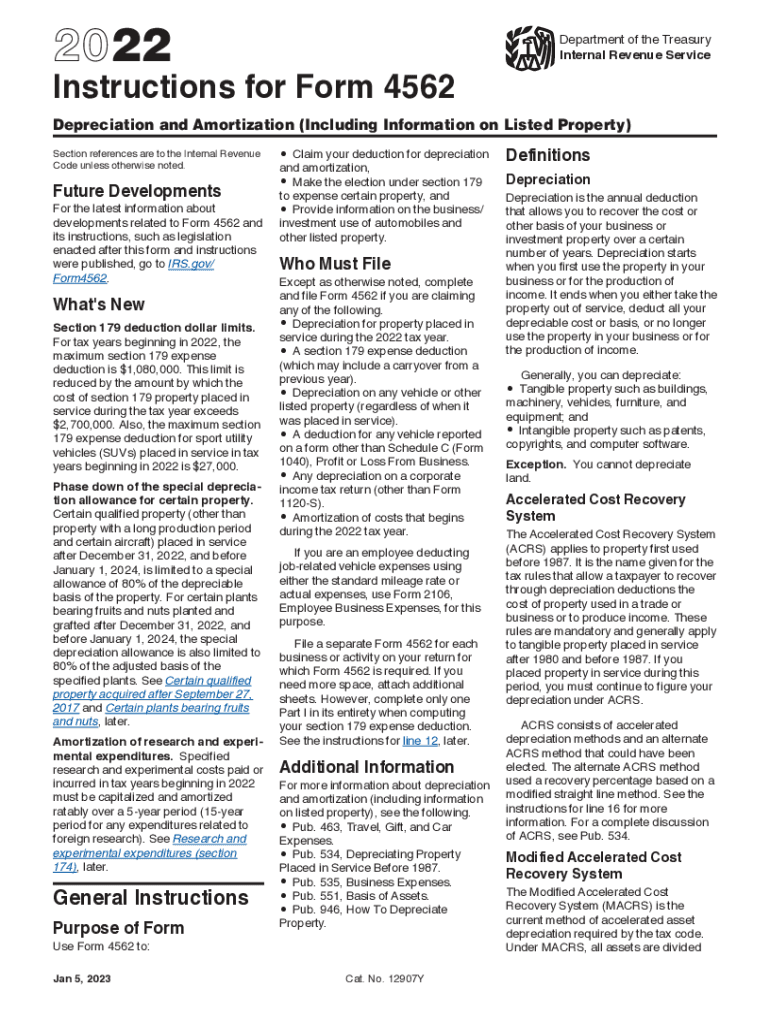

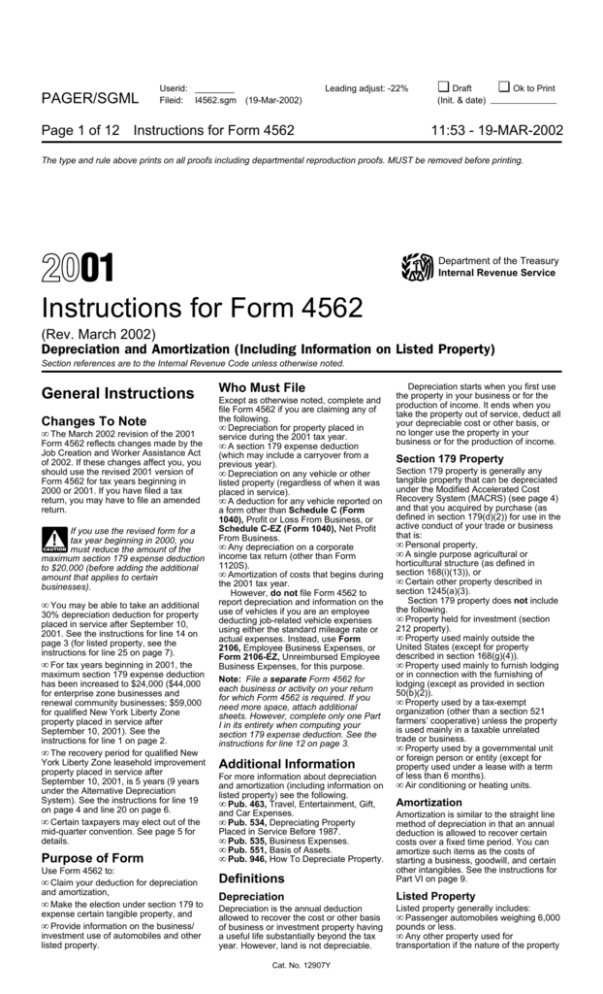

Form 4562 Instructions 2024. What instructions are essential for completing the depreciation and amortization report on form 4562? Department of the treasury 2020 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property)

Take time to make sure you complete your claim form accurately. Department of the treasury 2020 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property)

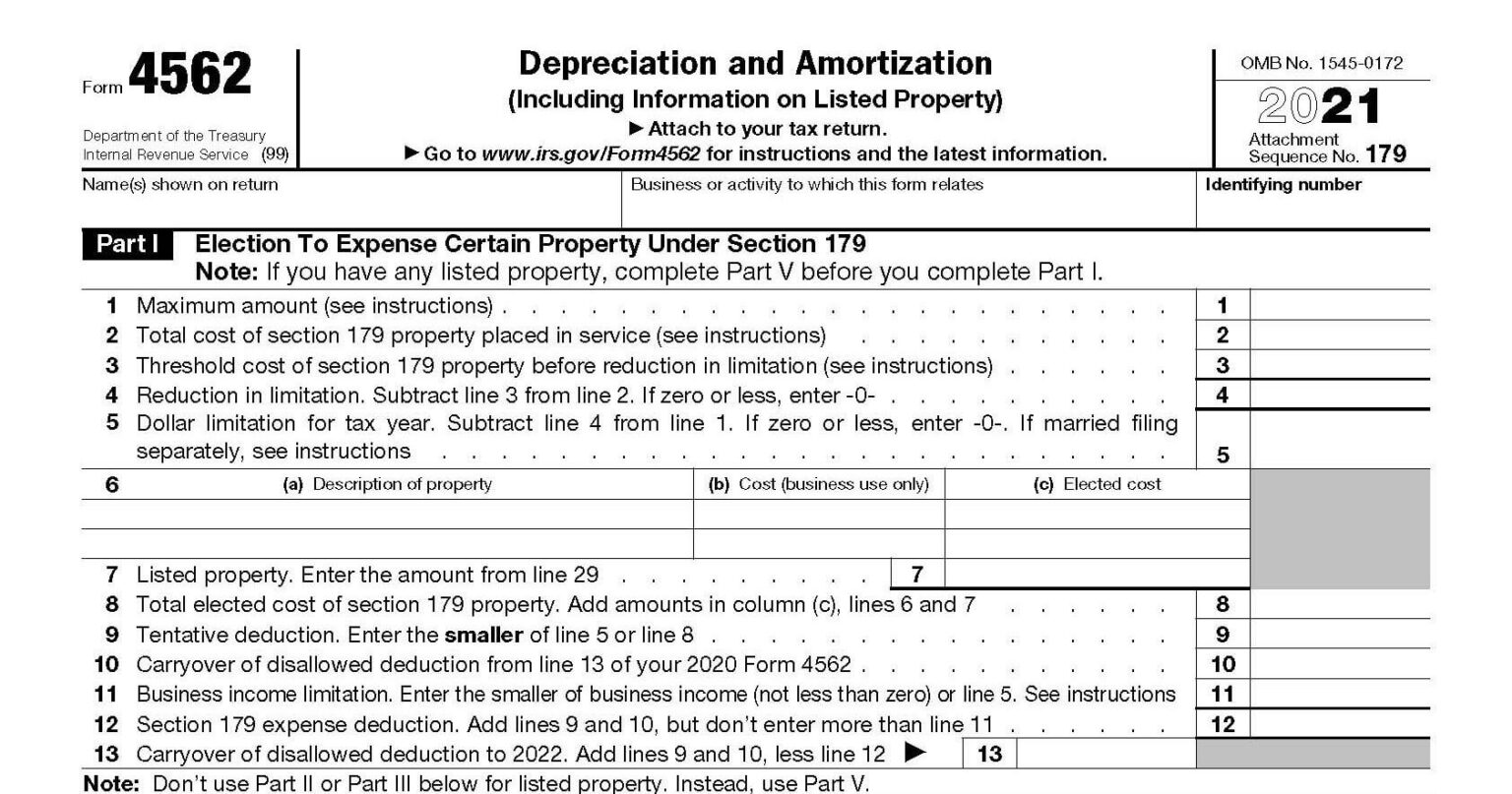

The Irs Allows Businesses To Claim A Deduction For Both Amortization And Deprecation By Filing Irs Form 4562, The Depreciation And Amortization Form.

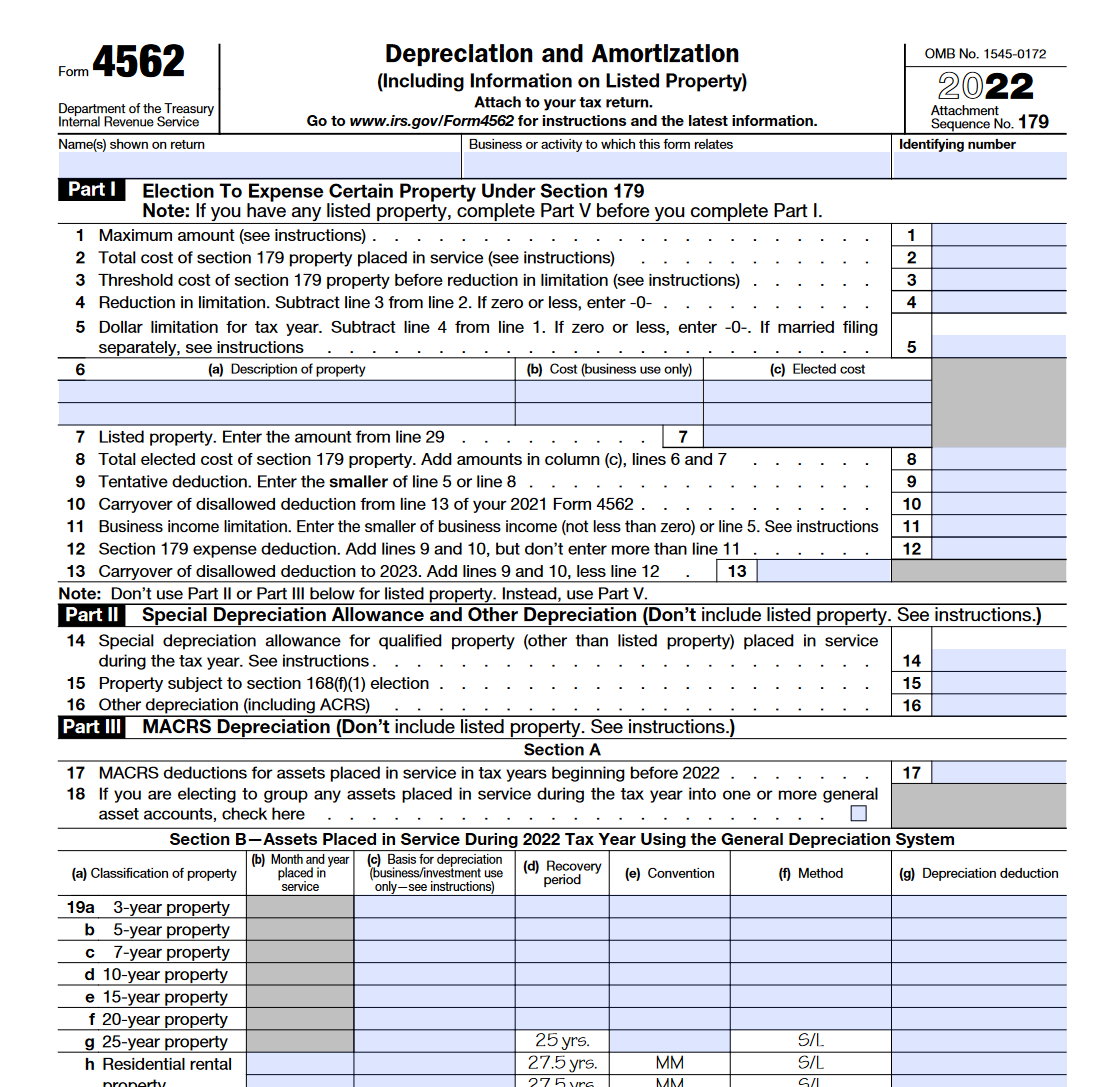

Irs updates instructions for form 4562 (2022) depreciation and amortization including immediate expense limit — orbitax tax news & alerts.

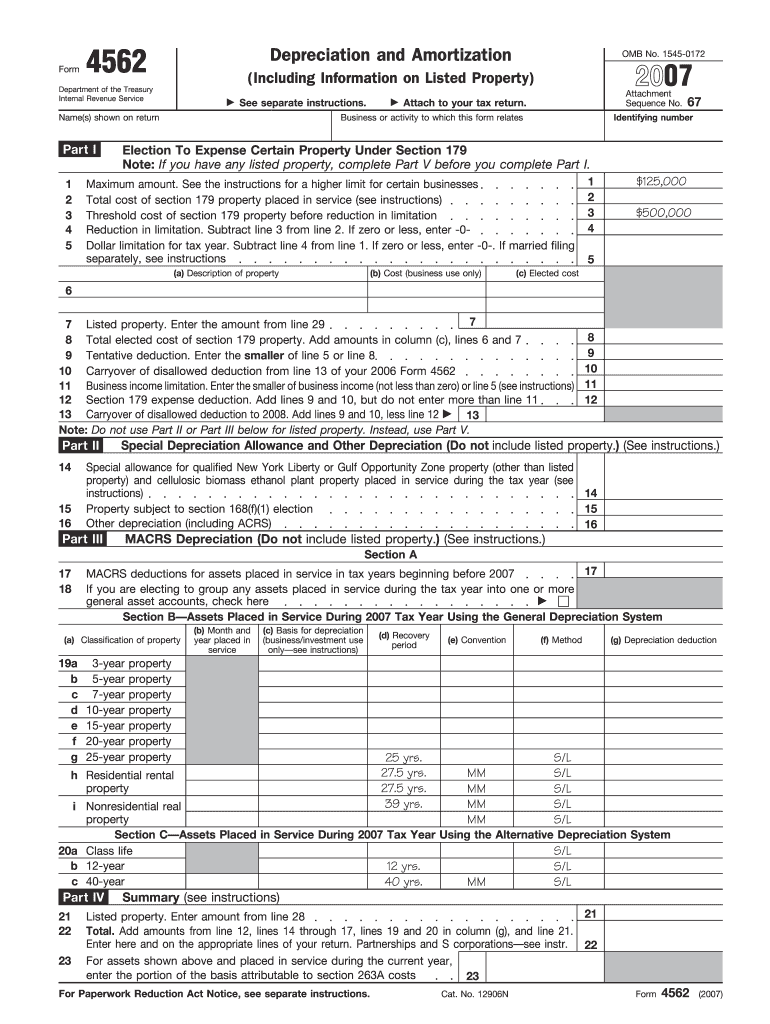

Form 4562 Department Of The Treasury Internal Revenue Service Depreciation And Amortization (Including Information On Listed Property) Attach To Your Tax Return.

Easily sign the form with your finger.

Open Form Follow The Instructions.

What is the irs form 4562?

Images References :

Source: www.dochub.com

Source: www.dochub.com

Form 4562 Fill out & sign online DocHub, Companies can update to this release for the latest tax. If you have read the notes and are still.

Source: www.signnow.com

Source: www.signnow.com

4562 20222024 Form Fill Out and Sign Printable PDF Template signNow, For 2024, the percentage drops to 60%. The irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form.

Source: www.zrivo.com

Source: www.zrivo.com

4562 Form 2023 2024, Complete this form if you are: This will help us to process your claim as quickly as possible.

Source: studylib.net

Source: studylib.net

Instructions for Form 4562, Department of the treasury 2020 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) What is the irs form 4562?

Source: www.mortgagerater.com

Source: www.mortgagerater.com

Form 4562 Instructions Your Foolproof Guide in 2024, Easily sign the form with your finger. Once you understand what each part of this tax form.

Source: blanker.org

Source: blanker.org

IRS Form 4562. Depreciation and Amortization Forms Docs 2023, Form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. What is the irs form 4562?

Source: studylib.net

Source: studylib.net

Form 4562 Instructions, Complete this form if you are: Easily sign the form with your finger.

Source: www.dochub.com

Source: www.dochub.com

Form 4562 Fill out & sign online DocHub, Section 179 deduction dollar limits. Form 4562 needs to be filed only if you plan to deduct a depreciable asset from your tax return.

Source: www.taxuni.com

Source: www.taxuni.com

Form 4562 2023 2024, Form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Irs form 4562 is used to claim deductions for depreciation and amortization for business assets.

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

How to Complete IRS Form 4562, Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • november 29, 2023 12:20 pm. Phase down of the special depreciation allowance for certain property.

Electing The Section 179 Deduction.

Learn what assets should be included on form 4562, as.

Phase Down Of The Special Depreciation Allowance For Certain Property.

Key instructions for completing form 4562 include identifying the taxpayer,.

Form 4562 Department Of The Treasury Internal Revenue Service Depreciation And Amortization (Including Information On Listed Property) Attach To Your Tax Return.

What is the irs form 4562?

Posted in 2024