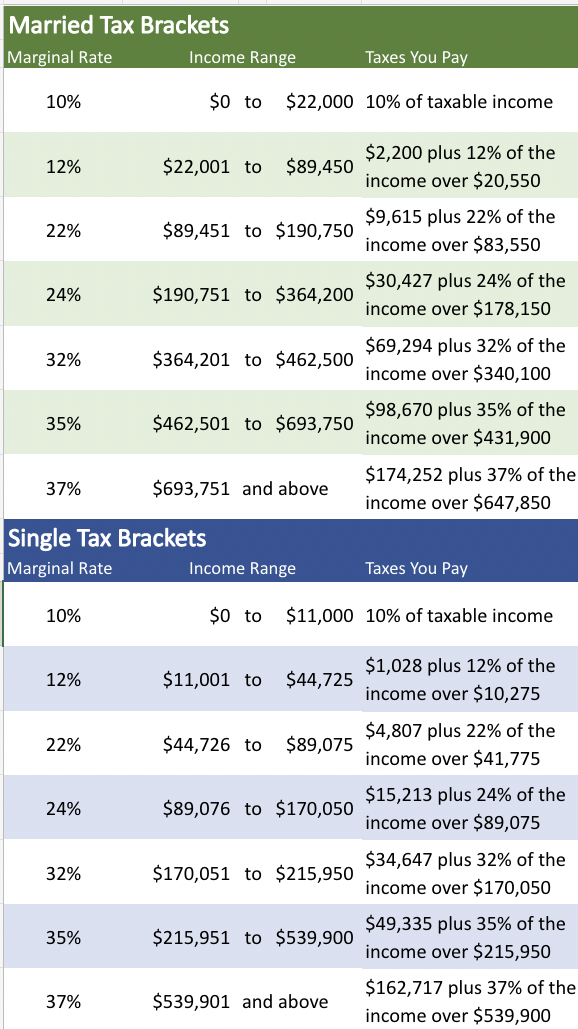

2024 Income Tax Tables Married Filing Jointly

2024 Income Tax Tables Married Filing Jointly. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2023, while heads of household will see a jump to $21,900 for heads of.

Arizona residents state income tax tables for married (joint) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Tax rate single filers married filing jointly or qualifying widow(er) married filing separately head of household;

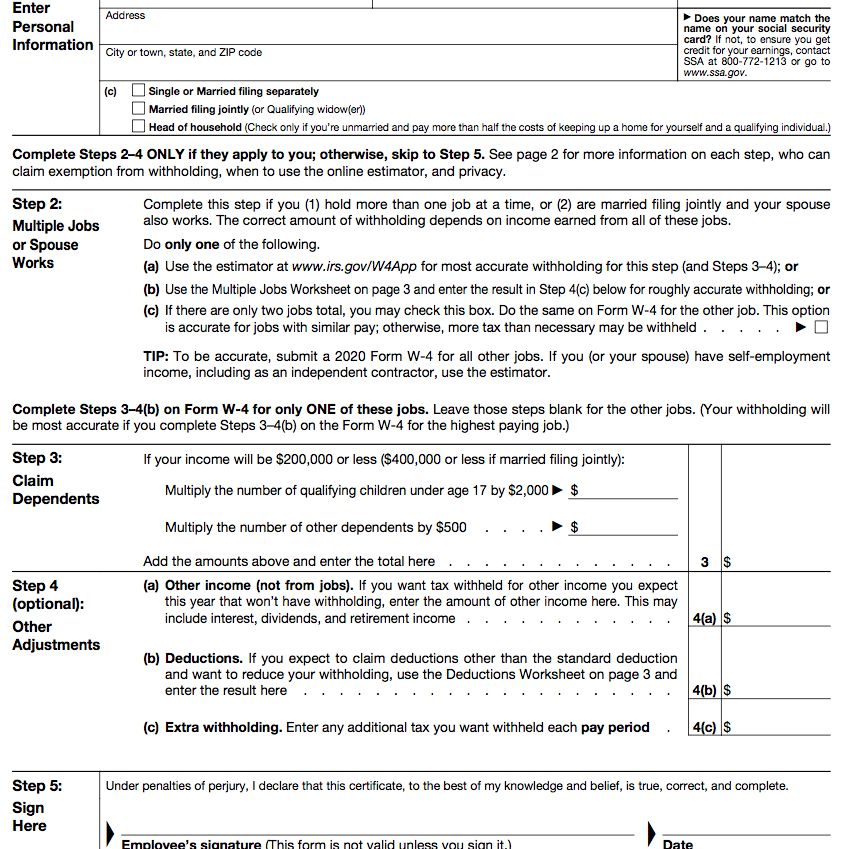

Single, Married Filing Jointly, Married Filing Separately, Or Head Of.

Wisconsin residents state income tax tables for married (separate) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income.

Married Filing Jointly Or Widowed.

You can’t make a roth ira contribution if your modified agi is.

The Standard Deduction Is The Fixed Amount The Irs.

Images References :

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

When Does Tax Filing Start 2022 2022 JWG, Married filing jointly or widowed. Single or married filing separately:

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: www.hotzxgirl.com

Source: www.hotzxgirl.com

Tax Tables Married Filing Jointly Printable Form Templates And Hot, Wisconsin residents state income tax tables for married (separate) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income. Page last reviewed or updated:

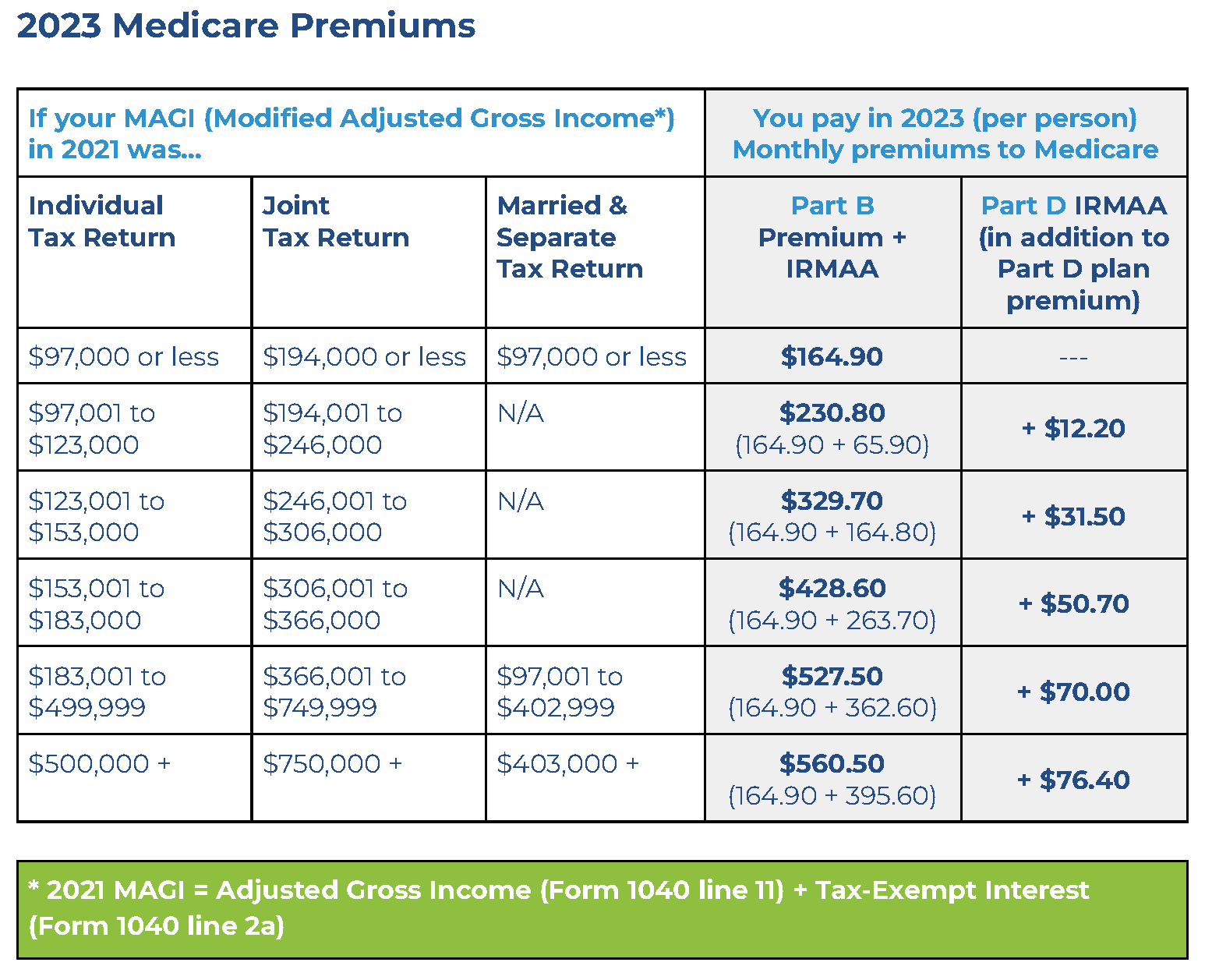

.png) Source: www.medicaremindset.com

Source: www.medicaremindset.com

Why Filing Taxes Separately Could Be A Big Mistake (when on Medicare, Single, married filing jointly, married filing separately, or head of. In 2024, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2023 ($13,850 and $27,700).

Source: andyqkerrill.pages.dev

Source: andyqkerrill.pages.dev

Federal Bracket 2024 Clara Demetra, Enter your total federal income tax withheld to date in. Tax rate taxable income (single) taxable income (married filing jointly) 10%:

Source: imagetou.com

Source: imagetou.com

Tax Calculator Canada 2024 Image to u, The standard deduction is the fixed amount the irs. Projected 2024 standard deduction by filing status.

Source: charissawhynda.pages.dev

Source: charissawhynda.pages.dev

Filing Taxes 2024 California Min Laurel, Wisconsin residents state income tax tables for married (separate) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income. Single, married filing jointly, married filing separately or head of household.

Source: finance.lutonilola.net

Source: finance.lutonilola.net

Incredible Us Tax Brackets 2021 References finance News, Single filers and married couples filing jointly; Single or married filing separately:

Source: forum.bodybuilding.com

Source: forum.bodybuilding.com

IRS Here are the new tax brackets for 2023, Tax rate single filers married filing jointly or qualifying widow(er) married filing separately head of household; Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2023, while heads of household will see a jump to $21,900 for heads of.

Source: www.purposefulfinance.org

Source: www.purposefulfinance.org

IRS 2023 Tax Tables, Deductions, & Exemptions — purposeful.finance, To figure out your tax bracket, first look at the rates for the filing status you plan to use: Tax rate single filers married filing jointly or qualifying widow(er) married filing separately head of household;

Source: psu.pb.unizin.org

Source: psu.pb.unizin.org

4.3 Tax Forms The Math of Money, But you may be able to exclude up to $250,000 of that gain from your income, or up to $500,000 if you and your spouse file a joint tax return. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Wisconsin Residents State Income Tax Tables For Married (Separate) Filers In 2024 Personal Income Tax Rates And Thresholds (Annual) Tax Rate Taxable Income.

To figure out your tax bracket, first look at the rates for the filing status you plan to use:

For Tax Year 2023, Or The Taxes You File In April 2024, These Are The Tax Brackets And Income Thresholds For The Various Filing Statuses:

Your filing status is married filing jointly or qualifying surviving spouse and your modified agi is at least $218,000.